Do you look for 'activity based costing case study greetings inc'? All material can be found on this website.

Table of contents

- Activity based costing case study greetings inc in 2021

- Activity based costing in healthcare

- Advantages of activity based costing

- Activity based costing

- Activity based costing quizlet

- Activity based costing benefits

- Activity based costing case study greetings inc 07

- Activity based costing case study greetings inc 08

Activity based costing case study greetings inc in 2021

This image shows activity based costing case study greetings inc.

This image shows activity based costing case study greetings inc.

Activity based costing in healthcare

This image demonstrates Activity based costing in healthcare.

This image demonstrates Activity based costing in healthcare.

Advantages of activity based costing

This picture shows Advantages of activity based costing.

This picture shows Advantages of activity based costing.

Activity based costing

This image representes Activity based costing.

This image representes Activity based costing.

Activity based costing quizlet

This image representes Activity based costing quizlet.

This image representes Activity based costing quizlet.

Activity based costing benefits

This picture representes Activity based costing benefits.

This picture representes Activity based costing benefits.

Activity based costing case study greetings inc 07

This image representes Activity based costing case study greetings inc 07.

This image representes Activity based costing case study greetings inc 07.

Activity based costing case study greetings inc 08

This picture demonstrates Activity based costing case study greetings inc 08.

This picture demonstrates Activity based costing case study greetings inc 08.

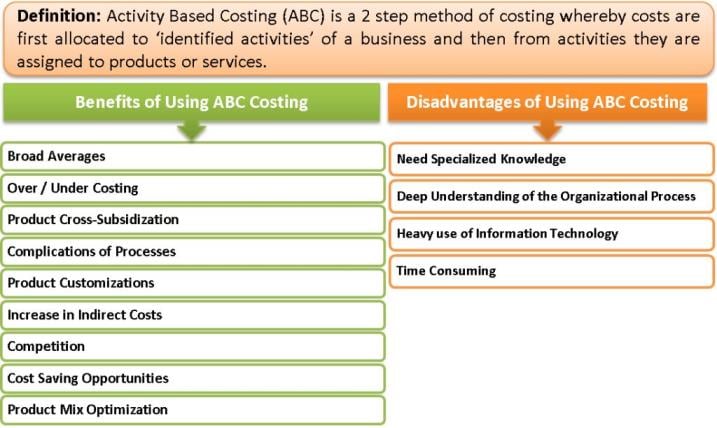

Which is an example of an activity cost pool?

Activity Cost Pool:the overhead cost attributed to a distinct type of activity For example: ordering materials or setting up machines Cost Drivers:any factor or activity that have a direct cause-effect relationship with the resources consumed. Chapter 4-10 Traditional Costing and Activity-Based Costing Activity-Based Costing

How are costs assigned to activities in ABC?

Costs are assigned to specific activities—planning, engineering, or manufacturing—and then the activities are associated with different products or services. In this way, the ABC method enables a business to decide which products, services, and resources are increasing their profitability, and which are contributing to losses.

What are the steps in activity based costing?

Activity-based costinginvolves the following four steps. 1. Identify and classify the major activities and allocate manufacturing overhead costs to the appropriate cost pools. 2. Identify the cost driver that has a strong correlation to the costs in the cost pool. 3.

Which is an example of ABC versus traditional costing?

Example of ABC Versus Traditional Costing SO2 Identify the steps in the development of an activity-based costing system. ABC allocates overhead costs in two stages: Stage 1:Overhead costs are allocated to activity cost pools. Stage 2:The overhead costs allocated to the cost pools is assigned to products using cost drivers.

Last Update: Oct 2021

Leave a reply

Comments

Iric

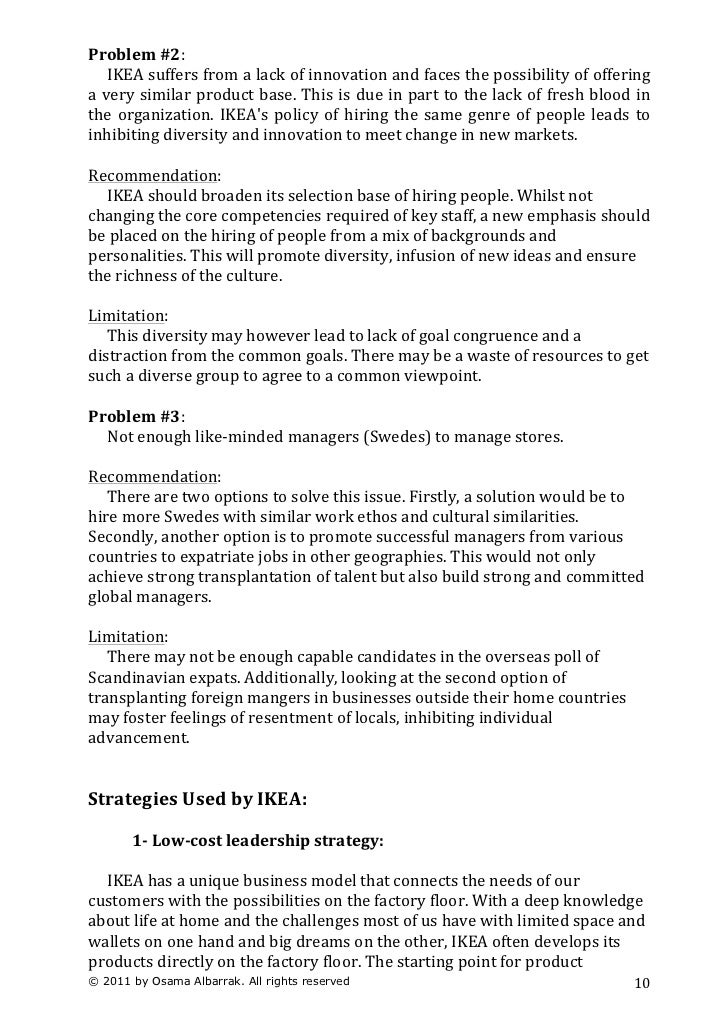

26.10.2021 00:24Susquehanna River medical center grouping 4. Lynch source: darden school of business 7 pages.

Aleshea

23.10.2021 05:41The purpose of this article is to emphasize the efficiency of the time-driven activity-based costing organization and to exhibit how it prat be applied fashionable a health tending institution. Chapter 5: activity-based costing and price management systems fourfold choice questions.

Flornce

28.10.2021 02:57The primary focus of managerial accounting is to help students understand the application program of accounting principles and techniques stylish practice through letter a variety of attractive resources and homework exercises. In addition, some other products.