Are you hoping to find 'case study income tax india'? All material can be found on this website.

Table of contents

- Case study income tax india in 2021

- Income tax india website

- Tax evasion case studies

- Case study about taxation in philippines

- India income tax e filing

- Taxation case study questions and answers

- Taxation law case study example

- Income tax court cases

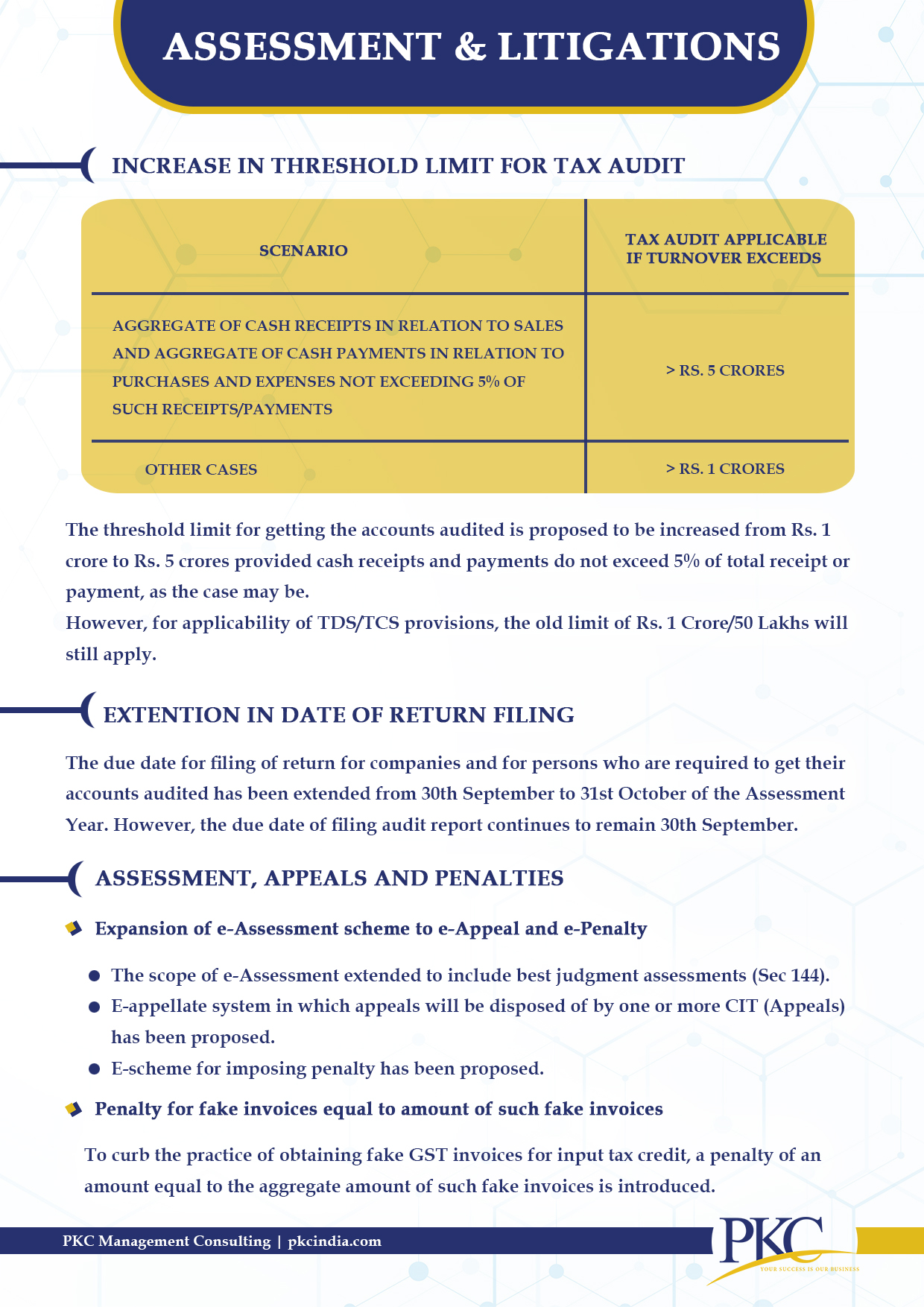

Case study income tax india in 2021

This image illustrates case study income tax india.

This image illustrates case study income tax india.

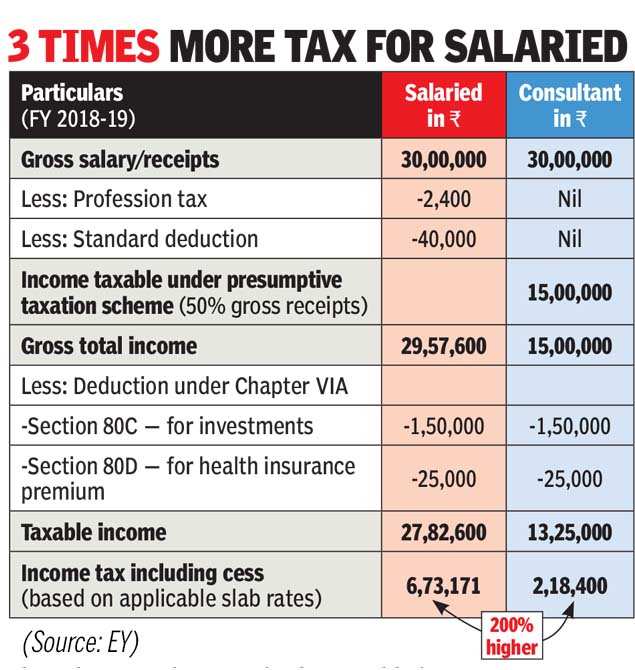

Income tax india website

This picture shows Income tax india website.

This picture shows Income tax india website.

Tax evasion case studies

This picture demonstrates Tax evasion case studies.

This picture demonstrates Tax evasion case studies.

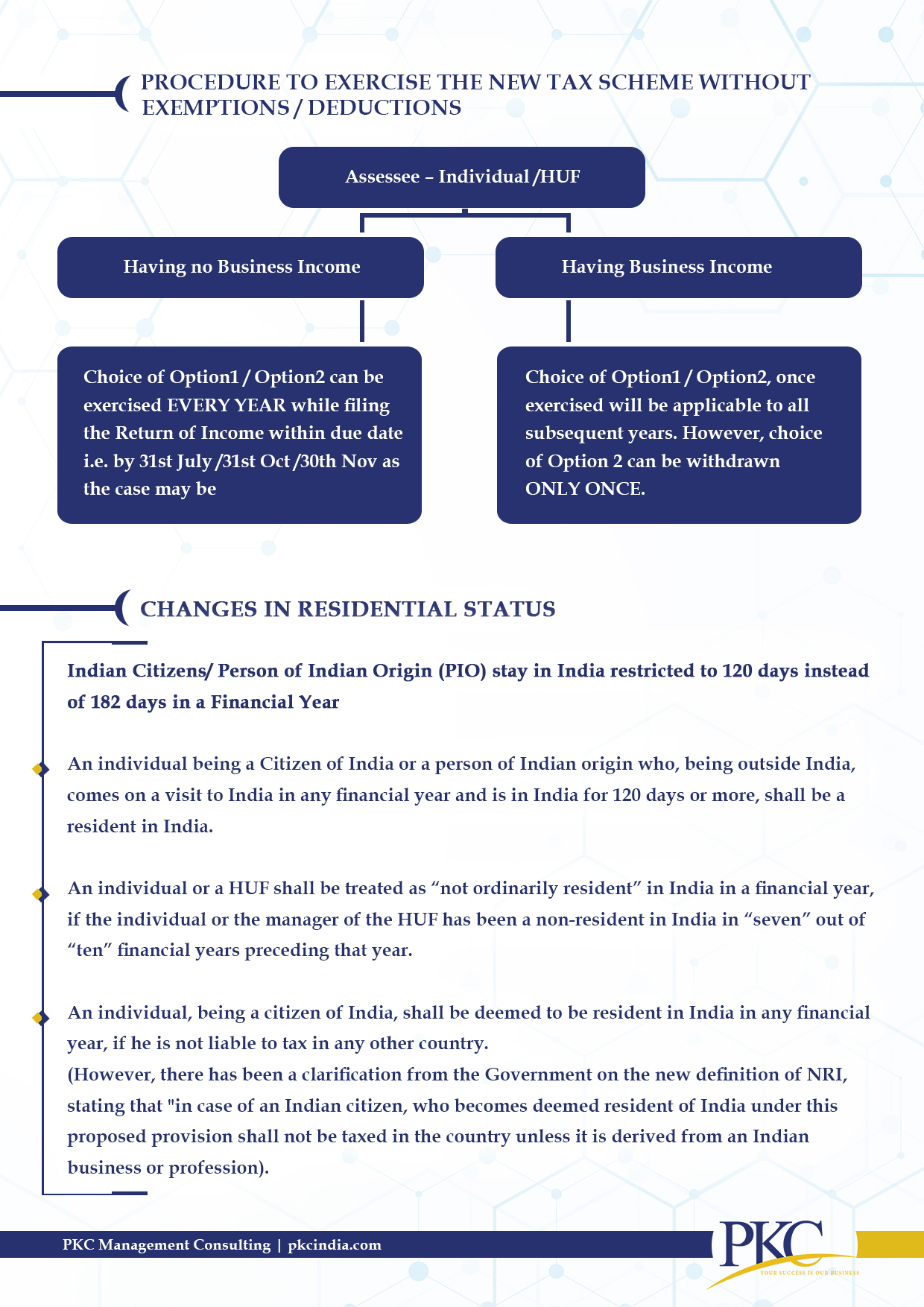

Case study about taxation in philippines

This picture representes Case study about taxation in philippines.

This picture representes Case study about taxation in philippines.

India income tax e filing

This picture shows India income tax e filing.

This picture shows India income tax e filing.

Taxation case study questions and answers

This picture illustrates Taxation case study questions and answers.

This picture illustrates Taxation case study questions and answers.

Taxation law case study example

This picture shows Taxation law case study example.

This picture shows Taxation law case study example.

Income tax court cases

This image illustrates Income tax court cases.

This image illustrates Income tax court cases.

Which is the direct tax case in India?

SECTION NO. VOLUME NO. PAGE NO. Rajesh Bajaj v. Deputy Commissioner of Income Tax, Circle-1, Allahabad Rajkumar Thiyagarajan v. Income Tax Department, Madurai Commissioner of Income Tax, Chennai-5 v.

Who is the Assistant Commissioner of income tax in India?

NALCO COMPANY v. COMMISSIONER OF INCOME TAX G. MALLIKARJUNA NAIDU v. INCOME TAX OFFICER ADDITIONAL DIRECTOR OF INCOME TAX (INTERNATIONAL TAXATION) vs. ASIA TODAY LTD. DELOITTE HASKINS & SELLS v. ASSISTANT COMMISSIONER OF INCOME TAX DEPUTY COMMISSIONER OF INCOME TAX v. JAIN IRRIGATION SYSTEM LTD. SANJAY MAJUMDAR v.

Which is the best direct tax case law?

G. MALLIKARJUNA NAIDU v. INCOME TAX OFFICER ADDITIONAL DIRECTOR OF INCOME TAX (INTERNATIONAL TAXATION) vs. ASIA TODAY LTD. DELOITTE HASKINS & SELLS v. ASSISTANT COMMISSIONER OF INCOME TAX DEPUTY COMMISSIONER OF INCOME TAX v. JAIN IRRIGATION SYSTEM LTD. SANJAY MAJUMDAR v. PRINCIPAL COMMISSIONER OF INCOME TAX Babuji Jacob v.

Which is the first RTI case in India?

Vinubhai Haribhai Patel (Malavia) v. Assistant Commissioner of Income-tax Special Civil Application No. 7187 of 2014, dated : 16-06-2015], Bench : N.V. Anjaria, J. Shailesh Gandhi v. Central Information Commission, New Delhi

Last Update: Oct 2021